We got talking about the Aylesbury

Property Market and this landlord brought up the subject of a report she had

read from the Royal Institution of Chartered Surveyors (RICS) and

PricewaterhouseCoopers (PwC) that stated almost 1.8m new rental homes are

needed by 2025 to keep up with current demand from tenants. She wanted to know

what this meant for Aylesbury.

Well, some commentators said last Winter that buy to let was

about to die, what with the new stamp duty changes and how mortgage tax relief

will be calculated. Others even said 500,000 rental properties would flood the

market nationally in the 12 months after the new Stamp Duty rules came into

force on the 1st April 2016 as landlords left the rental market. Well, I wish

all the landlords of those half a million properties would hurry up and put

them on the market – because I have plenty of other landlords wanting to buy

them!

Back to the matter in hand.. if the RICS and PwC are indeed

correct, what does this mean for Aylesbury? The fact is, as a country, we are

facing a precarious rental shortage and need to get Aylesbury building in a way

that benefits a cross-section of Aylesbury society, not just the fortunate few.

This government should drop the higher stamp duty tax on buy to let purchases

to ease the pressure on the rental market.

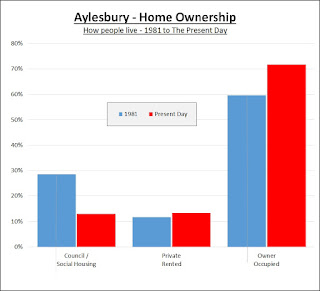

Of the 28,900 households in Aylesbury, currently 11,200 tenants

live in 4,700 private rented properties. If we apportion those 1.8m households

equally around the Country, that means in nine years’ time, the number of

rental properties in Aylesbury needs to rise by 2,000 (i.e. 42.8%) .. taking

the total number of rented properties in the town to 6,700.

That means Aylesbury landlords need to buy around 200 properties

a year every year between now and 2025 to meet that demand – because , an

additional 4,800 people will want to live in all those 'additional' Aylesbury

rental properties – so why is the government penalising landlords?

Thankfully the new housing minister Gavin Barwell detached

Teresa May's new administration from the Cameron/Osborne focus of just home

ownership to solve our housing issues, saying "we need to build more homes

for every single type of person needing a home and not focus on one single

tenure". The private rented sector became a stooge under David Cameron's watch

and still, with increasingly unaffordable Aylesbury house prices, the majority

of new Aylesbury households will be relying on the rental sector in the future

to house them. Westminster must put in place the measures that will allow the

rental sector to flourish. Any restrictions on the supply of rental property

will push up rents (bad news for tenants), thus side-lining those members of Aylesbury

society who are already struggling. Let's hope this new Government continues to

see the contribution landlords give to the country as a whole.

If you want to discuss your investment plans…where and what to

buy for the best returns get in touch ian@mortimersaylesbury.co.uk

|

| You coming for a swim dad? |